Investors are constantly searching for the next big opportunity in the stock market. One stock that’s catching attention is Tellurian Inc. (TELL), a relatively small player in the Liquefied Natural Gas (LNG) market. But is TELL stock a worthy buy for 2025? This blog dives deep into the company’s performance, market potential, and expert opinions to help investors decide if it fits their portfolio.

Tellurian Inc. at a Glance

Tellurian Inc. (NASDAQ: TELL) is a Houston-based company focused on natural gas production and developing low-cost liquefied natural gas (LNG) infrastructure projects. Founded in 2016, the company aims to make LNG affordable and accessible worldwide. Tellurian’s flagship project, Driftwood LNG, is at the heart of its operations—a massive initiative to revolutionize how natural gas is exported globally.

Tellurian’s business taps into the growing demand for LNG as a cleaner alternative to traditional fossil fuels in the energy sector. The global shift toward cleaner energy sources has positioned LNG as a critical transition fuel, making Tellurian well-situated within the energy market. However, the company’s ambitious goals come with challenges, including financial uncertainties and fluctuating market dynamics.

How Has TELL Stock Performed?

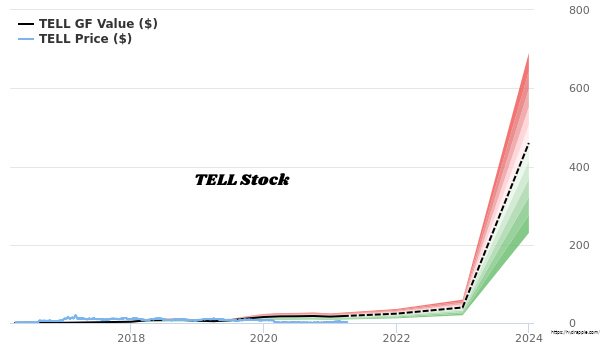

For investors analyzing Tellurian, its historical stock performance is a key metric. Over the past few years, TELL stock has been volatile, reflecting the broader uncertainty in energy markets and the capital-intensive nature of LNG infrastructure development.

As of today, Tellurian’s stock trades at approximately $0.949. Analysts offer a price target ranging from $1.00 (low and high) to an average increase of 5.33% from the current price. While the price forecast indicates marginal growth, it’s essential to consider the stock’s rollercoaster history, including sharp spikes and steep drops tied to project announcements, LNG market demand, and macroeconomic conditions.

Analyst Opinions on TELL Stock

Experts appear cautiously optimistic yet hesitant about Tellurian. According to Wall Street, the analyst consensus for TELL is a “Hold” rating based on the reviews of a single analyst. This cautious outlook reflects the potential rewards of Tellurian’s LNG projects and the risks associated with delayed execution, volatile commodity prices, and heavy capital expenditures.

While the price target of $1.00 represents a modest upside, investors should weigh this growth potential against the uncertainties surrounding the company’s ability to meet its ambitious goals and scale its operations effectively.

SWOT Analysis of Tellurian

Here’s a SWOT analysis of the company and its stock to better assess Tellurian’s potential as an investment.

Strengths:

- Positioned in a high-demand sector as the world shifts to cleaner energy.

- Innovative projects like Driftwood LNG could drive future revenues.

- Growing interest in LNG as a global energy solution gives Tellurian an edge if their projects succeed.

Weaknesses:

- High debt levels and significant capital intensity for infrastructure development.

- Project delays and market fluctuations drive stock volatility.

- Limited scale compared to competitors in the LNG space.

Opportunities:

- Global energy transition trends and increased LNG adoption.

- Completion of Driftwood LNG could generate massive revenue streams.

- Premium pricing potential as LNG becomes more sought after during energy shortages.

Threats:

- Competition from established LNG giants like Cheniere Energy.

- Regulatory changes and environmental policies impacting LNG projects.

- LNG market oversupply leads to reduced pricing power.

What’s Next for TELL Stock?

When evaluating the prospects for TELL stock, it’s essential to consider macroeconomic trends and company-specific developments. Globally, the LNG market outlook remains positive, with demand expected to grow 3-4% annually as regions like Asia and Europe increase consumption. This gives Tellurian room to grow if their Driftwood project—projected to produce about 27 million tonnes per annum—proceeds as planned.

However, delays in financing and construction have cast doubt on the project timeline, and competition in the LNG space is fierce. Established companies with fully operational LNG projects pose a significant challenge to Tellurian, which is still in development.

For short-term investors, TELL stock may continue to offer volatile swings driven by project updates and global energy developments. For long-term investors, the potential lies in Tellurian’s ability to execute its Driftwood project, secure financing, and capitalize on favourable LNG market conditions.

Should You Buy TELL Stock in 2025?

TELL stock presents a complex investment case. On the one hand, Tellurian operates in a promising industry with significant growth potential as the demand for LNG expands globally. If the Driftwood project succeeds, the company could see a substantial revenue and market share uptick.

On the other hand, the risks are equally prominent. From high debt to execution delays, Tellurian faces steep challenges in achieving its goals. Analyst ratings and price targets are cautious, suggesting that TELL stock is not a slam dunk for most investors.

For seasoned, risk-tolerant investors willing to bet on the future of LNG and Tellurian’s projects, TELL stock could be a speculative addition to a diversified portfolio. For others, the limited current growth potential and ongoing uncertainties may make it less appealing compared to more stable energy stocks.

Conducting thorough research, monitoring Tellurian’s project updates, and consulting a financial advisor to align investments with your goals are critical before making your investment decision.